Association memberships is one rough gauge of the number of purchasing decision

makers for this product among the Professional Residential and Commercial

Construction/Maintenance/Renovation segment.

The combined membership of the largest five associations is 274,616.

They are:

- American Subcontractors Association (ASA) Members: 5500.

- Associated Builders and Contractors (ABC) Members: 19000.

- Associated General Contractors of America (AGC) Members: 34416.

- National Association of Home Builders (NAHB) Members: 208000.

- National Association of the Remodeling Industry (NARI) Members:

7000.

- National Frame Builders Association (NFBA) Members: 700.

There are more than 150 publications dedicated to this industry.

There is highly suggestive evidence that the worldwide demand, for a product of

this type, is quite strong.

- Between its introduction in 1968 and 1981 over 10 million Black &

Decker Workmates® were sold worldwide.

- B&D currently sells four different versions of the Workmate®

- There are four other brands of virtually identical products.

- A fifth manufacturer, Rockwell, has recently entered this market with

a similar design (a vise on a stand) of similar capabilities.

- The top three US portable saw horse manufacturers (Trojan, Fulton

and Crawford) regularly report sales of $9M - $11M annually

(combined)

It is difficult to get a precise handle on the market size in dollars. Eli Tables fit in

NAICS 3332103396 ("Parts, attachments, and accessories for woodworking

machinery sold separately excluding saw blades and cutting tools"), but products of

this type only account for 35% - 40% of the entire category.

The worldwide demand, for this NAICS category as a whole, is estimated at $4.6B,

over the next five years* . [$4.6B x 35%/40% = $1.6B - $1.8B]

Accordingly, over the next five years* a 10% market share would be approximately

$170M

This worldwide demand is not evenly distributed.

Asia accounts for about 35%,

Africa Europe and the Middle East about 33%,

North America and the Carribean about 23%,

Latin America 7% and Oceania 1%

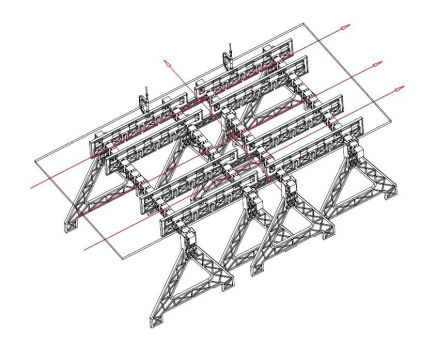

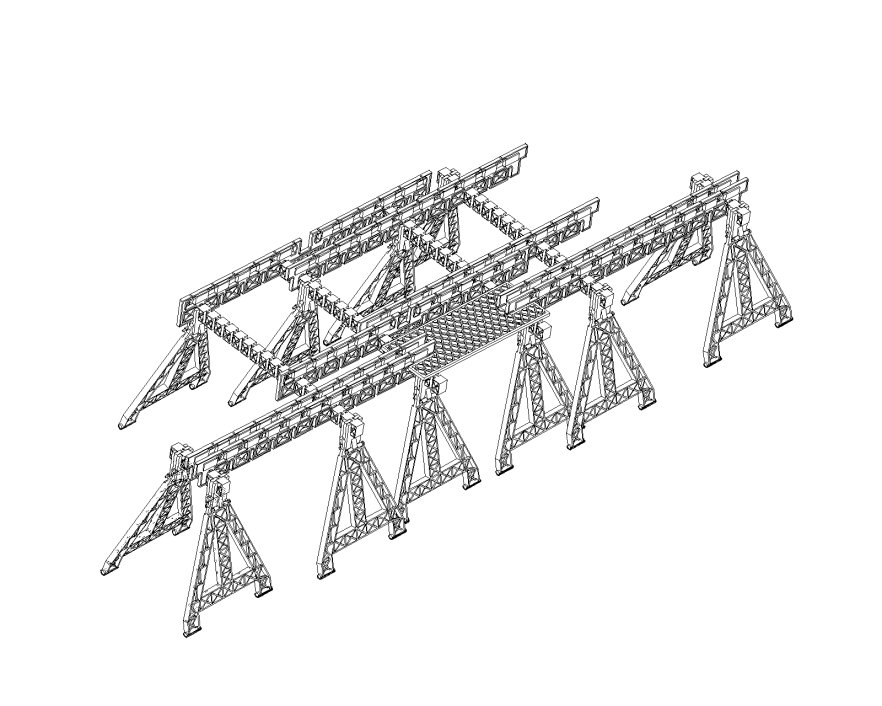

The modularity of the design also opens up a second revenue stream in renting and leasing parts on an as-needed basis.

Market Research

The information herein contained was obtained from Public Records, Dun &

Bradstreet Reports and other resources available at the Science, Business &

Industry Library (NYPL).

* The estimate of market size and worldwide distribution relies on “The 2007-2012

World Outlook for Woodworking Machinery Parts, Attachments, and Accessories

Sold Separately Excluding Saw Blades and Cutting Tools” by Professor Philip M.

Parker

Target Market

‘ Professional Residential and Commercial

Construction/Maintenance/Renovation Providers

‘ Homeowners, Owner-Operators and Do-it-Yourselfers

‘ Multi-Use and Reconfigurable Manufacturing Facilities

Marketing Mix Strategy

The overall marketing strategy is informed by Malcolm Gladwell’s “The Tipping

Point”. The basic objective is to get Eli Table sets into the hands of influential early

adopters.

One such group are the professional Theatrical and Event Services providers,

among whom I have many contacts. Another group are the community based home

construction/renovation non-profits.

No effort should be spared to get favorable exposure on the D-I-Y programs on PBS

and in the trade media.

Separate, but coordinated marketing efforts to governmental agencies and large

contractors should also be undertaken

Another marketing objective is ready availability. In the North American region e.g.

Eli Tables should be available both in the big-box stores and via the major online

merchants.

Promotions

Because Eli Tables represent a paradigm shift, a new way of doing things, serious

promotion will be required.

One such might be a demonstration tour through the big-box store locations.

Another might by organizing “Guiness Book” events. There is no theoretical limit to

the size of an Eli Table. Getting a large group of owners together to create one.the

size of a Home Depot parking lot; would make that point very vividly and attract

press attention.

A key conceptual component of Eli Tables is their use as a platform for user built jigs

and fixtures. Design competitions and/or prizes for interesting applications and an

Internet accessible knowledge base “Tips & Tricks” would also be useful. It is

probably no longer possible to have a product which does not have (in addition to a

website) a presence on thee social networks.